Churchill

Churchill, an investment-specialist affiliate of Nuveen (the asset manager of TIAA), provides customized financing solutions to U.S. middle market private equity firms and their portfolio companies across the capital structure. With over $63 billion of committed capital, we provide first lien, unitranche, second lien and mezzanine debt, in addition to equity co-investments, secondary solutions and private equity fund commitments. Churchill has a long history of disciplined investing across multiple economic cycles and our unique origination strategy and investment approach are driven by over 200 professionals in New York, Charlotte, Chicago, Los Angeles and Palm Beach. Together with our sister company Arcmont Asset Management, we comprise Nuveen Private Capital, an $94 billion private capital platform and one of the largest private debt managers globally.

In the news

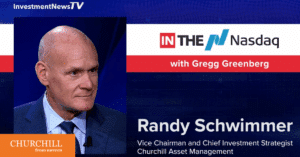

InvestmentNews: Why the current boom in private credit won’t dent future demand

New York, November 25, 2025 – Randy Schwimmer, vice chairman and chief investment strategist at Churchill Asset Management, sits down with InvestmentNews anchor Gregg Greenberg to explain why the demand for private credit won’t slow down in the coming year despite the influx of new entrants into the market.

Insights

Private capital call

EP17: Don Calcagni on building a fortress balance sheet for private wealth investors

This month, we are delighted to welcome Donald Calcagni, Chief Investment Officer at Mercer Advisors, who will share his insights on supporting private wealth investors in building resilient balance sheets across public and private markets.

Events

Featured transactions

-

CRS Housing

Lender

- Equity

- Subordinated Note

Ridgemont Equity Partners

December 2025

-

MFG Chemical

Co-Lead Arranger

- Unitranche Credit Facility

Windjammer Capital Investors

December 2025

-

ReVamp Companies

Lender

- Equity

- Subordinated Note

Calera Capital

December 2025

-

Marshall and Stevens

Co-Lead Arranger

- Senior Secured Credit Facility

Coalesce Capital

December 2025

-

CJS Global

Lender

- Equity

- Subordinated Note

Shoreline Equity

December 2025

-

Schill Grounds Management

Investor

- Equity

TruArc Partners

December 2025

-

USA Industries

Sole Lead Arranger

- First Lien Credit Facility

Levine Leichtman Capital Partners

December 2025

-

Enviromatic Systems

Lead Left Arranger

- Senior Secured Credit Facility

Wind Point Partners

December 2025

-

Perennial Services Group

Lead Left Arranger

- Senior Secured Credit Facility

Brentwood Associates

December 2025

-

Guardian Fire Services

Co-Lead Arranger

- Senior Secured Credit Facility

Investcorp

December 2025

-

Vona

Investor

- Equity

NMS Capital

November 2025

-

Kanawha Scales & Systems

Investor

- Equity

Investcorp

November 2025

-

Grant Street Group

Investor

- Equity

Welsh, Carson, Anderson & Stowe

November 2025

-

Shermco

Lender

- Senior Secured Credit Facility

The Blackstone Group

October 2025

-

Force Electrical Services

Sole Lead Arranger

- Senior Secured Credit Facility

SkyKnight Capital

October 2025

-

ARC Health

Lender

- Subordinated Note

Thurston Group

October 2025