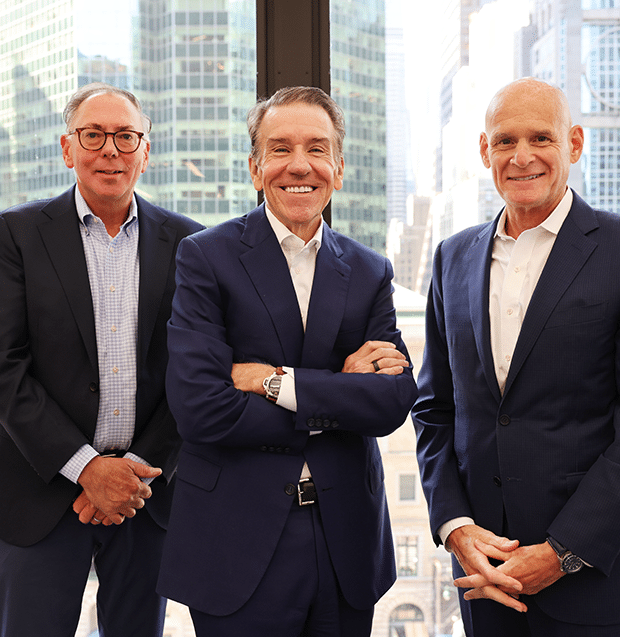

Exclusive: Churchill and Arcmont chief executives reveal global strategy

New York, April 2, 2025 – Ken Kencel and Anthony Fobel met in 2019 at an industry conference. What was meant to be a half an hour catch-up turned into two hours spent chatting. Something had just clicked. And a deal was signed in 2022.