We really view our LP commitments through a partnership lens. We invest as a significant limited partner and often serve as an advisory board member offering our GPs our full suite of firmwide value added capabilities up and down the balance sheet.”

Anne Philpott, CFA

Head of Private Equity Fund Investments

Investment criteria

PE fund investments

Target fund size2

$500 mm - $2.5 bn+

Commitment size3

$30 - $60 mm

Churchill’s select private equity fund relationships

Churchill has committed $12+ billion in middle market private equity funds driving improved access to deal flow.

Primary strategy

Diversified

Industry specialist

Operationally focused

Sourcing specialists

Small-cap/LMM focus

News & Press

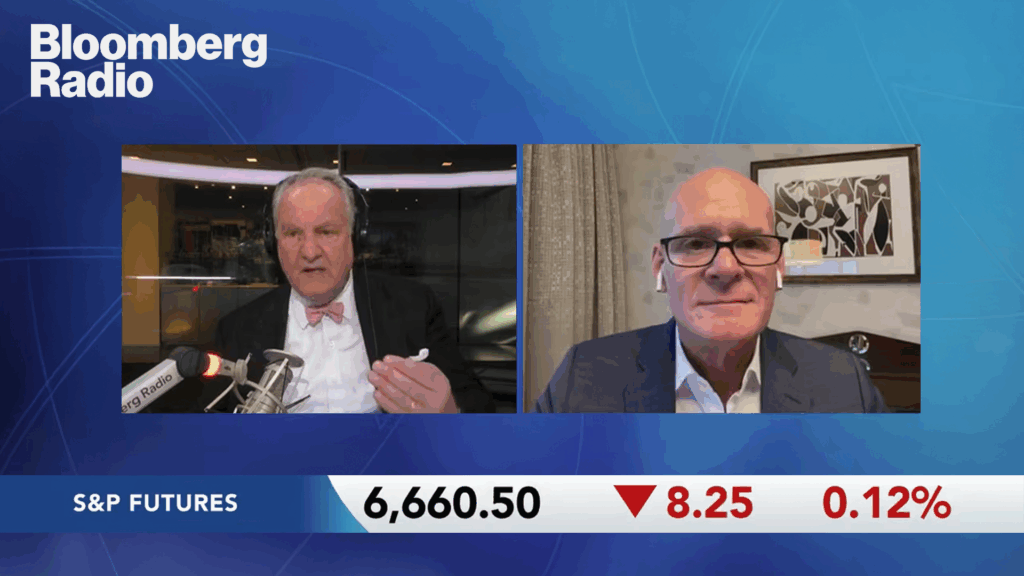

Randy Schwimmer live on Bloomberg Surveillance Radio

New York, October 17, 2025 – In this podcast, Randy provides important insight on how lending to sponsor backed traditional core middle market businesses can help insulate investors from the volatility affecting other segments.

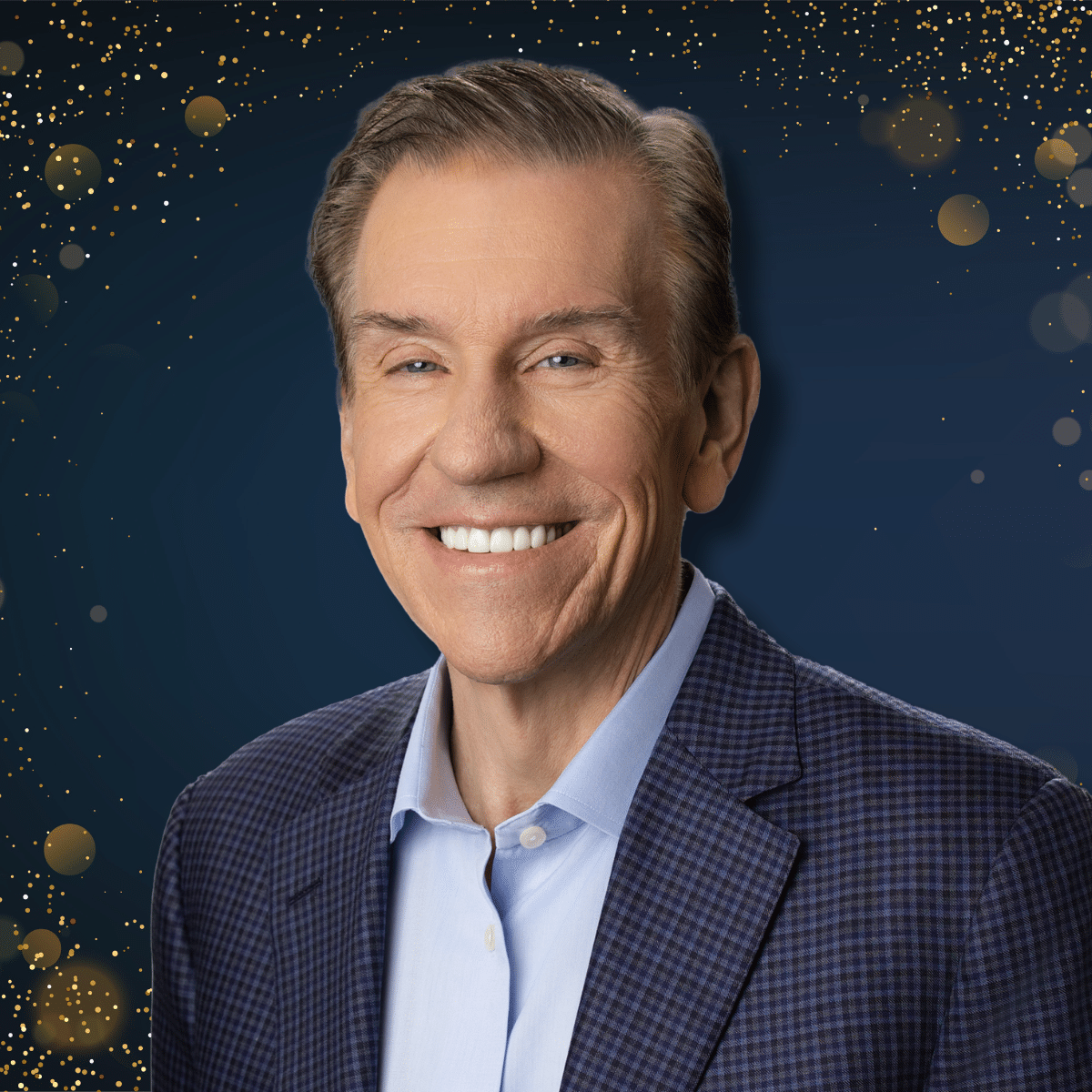

Churchill’s Ken Kencel to receive the 2025 Lifetime Achievement Award and be inducted into the M&A Advisor Hall of Fame

New York, NY, October 14, 2025 – The M&A Advisor is proud to announce that Ken Kencel, President and CEO of Churchill Asset Management, will be recognized as The M&A Advisor’s 2025 Lifetime Achievement Award recipient. Mr. Kencel will be honored for his significant contributions in the fields of private capital and middle-market finance at the 2025 Future of Dealmaking Summit, on November 18th & 19th in New York City. Mr. Kencel will also be formally inducted into The M&A Advisor’s Hall of Fame…

Nuveen Private Capital, Hunter Point Capital and Temasek Announce Strategic Partnership

New York, NY, September 3, 2025 – Nuveen Private Capital, comprising U.S. and European asset managers Churchill Asset Management and Arcmont Asset Management, has entered into a strategic partnership with Hunter Point Capital (“HPC”), an independent investment firm that provides capital solutions and strategic support to alternative asset managers, and Temasek, a global investment company headquartered in Singapore. HPC and Temasek are making minority investments in Nuveen Private Capital and Temasek will provide long-term capital commitments to the platform’s new and existing strategies…