Churchill is one of the largest and most experienced private debt managers in the U.S., ranking #1 most active U.S. Buyouts Lender for 2024 by PitchBook1.”

Mathew Linett

Head of Senior Lending

Investment criteria

Senior lending

Company size (EBITDA)

$10 - $100 mm

Target position size

$50 - $500 mm

Target markets

- Traditional middle market

- Upper middle market club

Capabilities

- 1st lien

- Unitranche

- Revolving credit

- DDTL

Insight

Industry expertise

From our experience in investing through various cycles, we have deep expertise across a broad range of industries. We focus on issuers with strong market positions, differentiated value propositions and sustainable competitive advantages.

Recent transactions

-

Enviromatic Systems

Enviromatic Systems

Lead Left Arranger

- Senior Secured Credit Facility

Wind Point Partners

December 2025

-

Guardian Fire Services

Guardian Fire Services

Co-Lead Arranger

- Senior Secured Credit Facility

Investcorp

December 2025

-

Kanawha Scales & Systems

Kanawha Scales & Systems

Lead Left Arranger

- Senior Secured Credit Facility

Investcorp

October 2025

-

Heartland Business Systems

Heartland Business Systems

Lead Left Arranger

- Senior Secured Credit Facility

GenNx 360 Capital Partners

October 2025

News & Press

Churchill Asset Management Named 2025 Lender Firm of the Year by The M&A Advisor

New York, NY, December 1, 2025 – Churchill Asset Management LLC (“Churchill” or the “Firm”), an investment specialist of Nuveen, announced it was named the 2025 “Lender Firm of the Year” by The M&A Advisor.

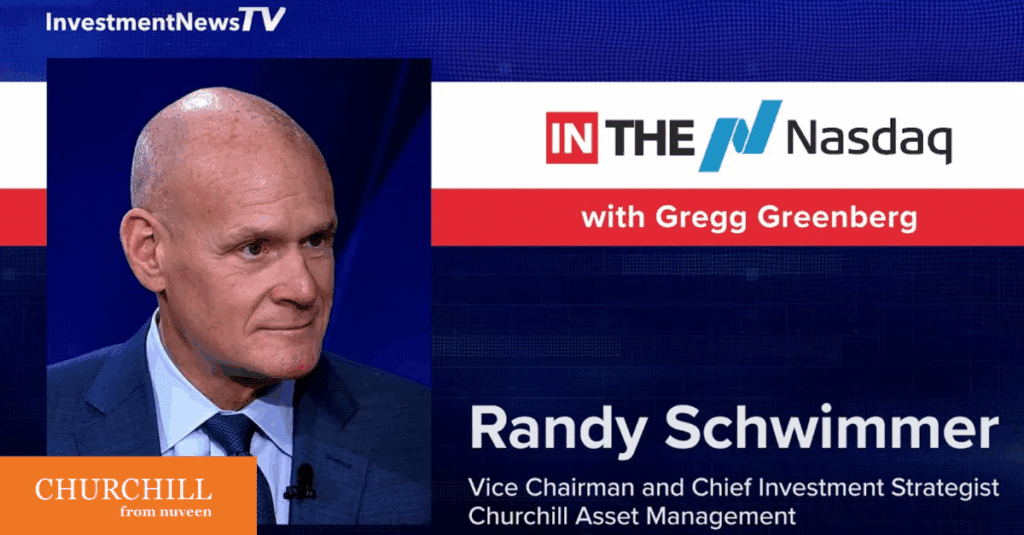

InvestmentNews: Why the current boom in private credit won’t dent future demand

New York, November 25, 2025 – Randy Schwimmer, vice chairman and chief investment strategist at Churchill Asset Management, sits down with InvestmentNews anchor Gregg Greenberg to explain why the demand for private credit won’t slow down in the coming year despite the influx of new entrants into the market.

Bloomberg Open Interest: Churchill’s Kencel Expects New Entrants Into Private Credit

New York, November 14, 2025 – Churchill Asset Management President and CEO Ken Kencel discusses the state of the private capital market, takeaways from his firm’s Annual Investor Meeting and how mid-market companies are participating in a data center boom.